south carolina food tax

The South Carolina State Park Service hopes you will remember your state parks at tax time. What this means for extension filers who are eligible for the rebate.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

The Greenville City Council authorizes the levy of a 2 Local Hospitality Tax on prepared meals and beverages including alcoholic beverages beer and wine sold in the City of Greenville.

. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7. The cost of a South Carolina FoodBeverage Tax depends on a companys industry. A 25 tax collected for the rental of qualified heavy industrial equipment that is rented for 365 days or less.

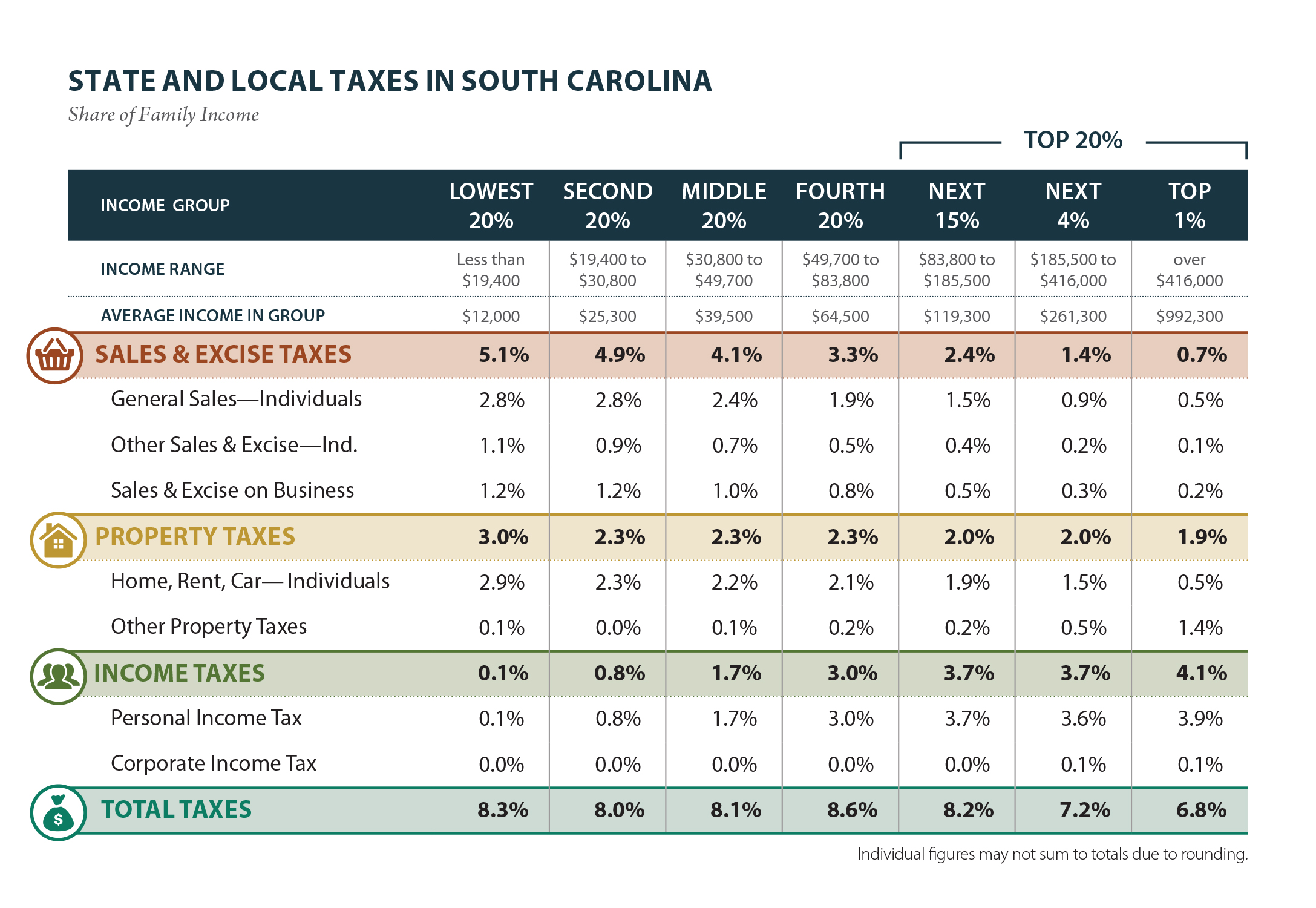

A customer buys a toothbrush a bag of candy and a loaf of bread. Alcoholic beverage excise and sales taxes in South Carolina are among the highest in the US. The statewide sales and use tax rate is six percent 6.

The cost of a South Carolina FoodBeverage Tax is unique for the specific needs of each business. South Carolina Liquor Tax - 272 gallon. Tax Manager Food Agriculture.

Counties may impose an additional one percent 1. The statewide sales and use tax rate is six. United States South Carolina Greenville Reliable Plus Tax and Financial Services.

Find Best Western Hotels Resorts nearby Sponsored. Job in Charleston - Charleston County - SC South Carolina - USA 29402. Y ou must have filed a South Carolina Individual Income Tax return SC1040 for tax year 2021 by October 17.

With local taxes the total sales tax rate is between 6000 and 9000. The Myrtle Beach South Carolina sales tax is 900 consisting of 600 South Carolina state sales tax and 300 Myrtle Beach local sales taxesThe local sales tax consists of a 100 city. Sales tax is imposed on the sale of goods and certain services in South Carolina.

South Carolinas general sales tax of 6 also applies to the purchase of liquor. Sales tax is imposed on the sale of goods and certain services in South Carolina. In addition to general state and local sales taxes the state.

What is the sales tax on food in South Carolina. South Carolina Alcohol Tax. You can do that by designating donations on Schedule I-330.

South Carolinas 2022-2023 budget was ratified by the legislature on June 16 2022 but South Carolina Governor Henry McMaster vetoed certain provisions on June 24 2022. Donate to SC State Parks. The statewide Sales Use Tax rate on the sale of goods and.

The state sales tax rate in South Carolina is 6000. This page describes the taxability of. Any resident who paid taxes will.

While South Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Secondly what is exempt from. 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC STATE AND LOCAL SALES TAX RATE ON UNPREPARED FOOD BY MUNICIPALITY Effective Jan 1 2022.

Item 4 are eligible for. Income tax refund checks of up to 800 will be sent out to South Carolina taxpayers starting in late November or December. Exemptions to the South Carolina sales tax will vary.

State sales and use tax under South Carolina Code 12-36-212075 provided it is not one of the foods listed above in SC Regulation 117-3371B Items 1. Unprepared foods that may lawfully be purchased with USDA food coupons. South Carolina has recent rate changes Sat Feb.

The following sales of food for human consumption are exempt from the state tax. In South Carolina liquor vendors are responsible for paying a state. The hospitality tax is a uniform tax of 2 on the gross proceeds derived from the sales of prepared meals food and beverages sold in or by establishments or those licensed for on.

The South Carolina sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the SC state sales tax.

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Sub Station Ii Menu In Spartanburg South Carolina Usa

State Our State Magazine North Carolina Digital Collections

South Carolina Sales Tax Guide

South Carolina Sales Tax Rate 2022

South Carolina Sales Tax Rate 2022

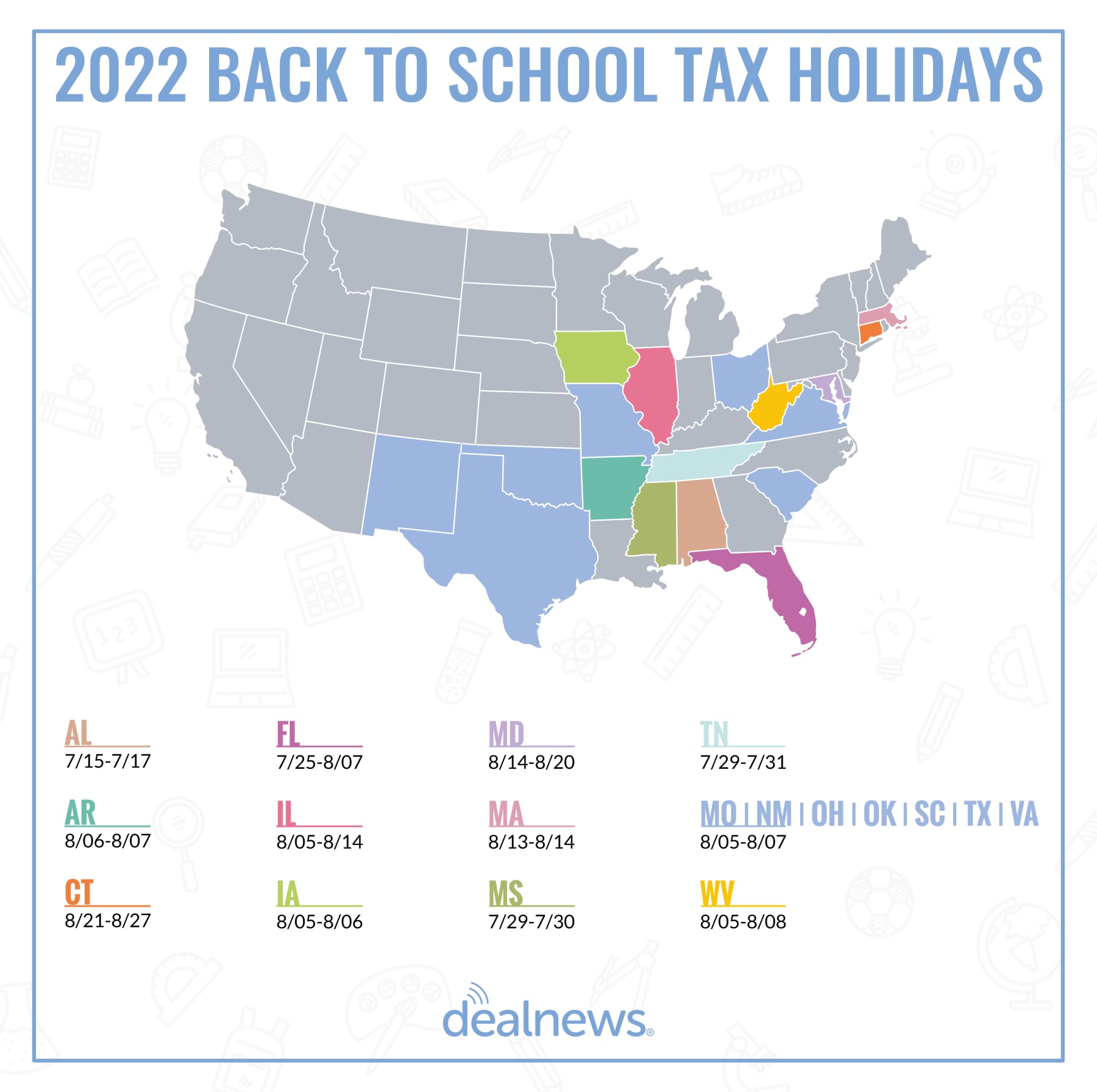

When Is Your State S Tax Free Weekend In 2022

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNMVCHIL3JBRBMDSRVGWGFJHGI.jpg)

Bill Could Reinstate Tax On Groceries

Hardee S Home York South Carolina Menu Prices Restaurant Reviews Facebook

Group Makes Petition Against Proposed Meal Tax

South Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Sc Tax Rates For Property Sales Vehicle Income For Sc Buyers

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Here S How Much Money You Could Get From Sc Income Tax Rebate Wltx Com

South Carolina Sales Tax Small Business Guide Truic

Sales Tax Holidays Politically Expedient But Poor Tax Policy

South Carolina Legislation News Blog Anderson Area Chamber Of Commerce Anderson Sc Sc

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Irs Extends Tax Deadlines For Hurricane Ian Victims In North Carolina And South Carolina